Introducing E-Man Venture Labs: leading London incubator evolves into company-building venture studio

E-Man Venture Labs has contributed hugely to the London economy as an innovative start-up incubator. Now it is reinventing itself as a full-blown venture studio.

E-Man is one of the powerhouses of the web revolution, making a huge but as yet unheralded contribution to the economies of London and the UK. Now, it is making an evolutionary step-change from tech incubator into a full-blown company-building venture studio, called E-Man Venture Labs, backed by a SEIS venture fund.

By any standards, E-Man is a great UK success story: the companies that it has nurtured from back-of-an-envelope ideas have amassed a combined valuation of over £1 billion, have generated over 2,000 hires and have benefitted from over £400 million in raised capital.

The company has seen three of its social apps and games exit since 2015. The last six ventures that successfully migrated out of E-Man Venture Labs have attained an average six-times return for founding shareholders. A great story for London tech.

And E-Man has expanded its horizons internationally: in 2014, it set up in the US to further expand its UK assets, whilst offering its services to US companies. E-Man companies launched into the US include Zazma, which became Behalf, raising $310 million, and social fitness platform, Burn This, which was quickly acquired byBeachBody LLC, alongside rapidly growing social networks Octane and Doppels.

Introducing E-Man Venture Labs

Introducing E-Man Venture Labs

This trajectory has now led to E-Man reinventing itself as E-Man Venture Labs, marking an evolutionary step-change to become a full-blown venture studio, backed by an SEIS fund. This move reflects the fact that E-Man has reached a crucial level of maturity, in terms of developing an ecosystem of enthusiastic investors and mutually beneficial alumni companies, plus across-the-board experience of all aspects of hatching companies from scratch.

Matt Hagger, E-Man’s Founder and CEO, explains what becoming a venture studio means: “When you start doing extraordinary work, you begin to see results. Results then give birth to an ecosystem where you can literally connect the dots, faster. We have relationships across investment and fund-raising, financial modelling, legal compliance, company set-up and scaling into the US. We’ve built an ecosystem of people'.

“With E-Man’s original business model, business founders lacking a technical co-founder would approach us with ideas and often some capital. Our focus was product development, from idea to minimal viable product, and by adding ourselves strategically to the cap table. In contrast, E-Man Venture Labs is a company-building ecosystem. People visited E-Man because they wanted a product built. Now it’s different. We’re a company-building conveyor belt. We expect far greater returns for everyone involved in the process.”

Eugene Kouumdjieff, Hagger’s fellow Founder at E-Man, adds: “The reason why we’re at this point now is that we’re fully equipped to do this ourselves. E-Man Venture Labs is a unique model: there aren’t a lot of people that actually do this - conceive, create, build, launch and scale ideas, then assemble management teams when the companies gain substance. But we’ve proved that we can do it, and now we have investors that will back us.”

E-Man launches Venture Fund

A key factor in the company’s evolution is E-Man Venture Labs’ own ideas fund, initially instituted in partnership with Growthdeck. Hagger explains: “It’s a pre-seed fund that we will invest in three or four ventures. Essentially, we’re going to have a level of governance over that.”

“We have spent the last 10 years working very closely with some of the most talented founders in the UK and ultimately, we are at the stage where we have the tools and experience to make well-educated decisions on market, timing and team.”

Growthdeck CEO Ian Zant Boer added: “By definition, putting money into early-stage SEIS opportunities is risky – that’s why you get the fantastic tax returns. But if you’ve got a company like E-Man Venture Labs, which appears to have cracked it, and has a flow of sufficiently good opportunities that it can translate into companies which make money, then having that underpinning a broad SEIS offering for our clients is fantastic. E-Man Venture Labs takes us into a part of the business world that we’re just not otherwise connected with at all. We love the company’s experience and track record.”

One idea that has benefitted from E-Man’s impact is Zoomdoc; an on-demand platform for seeing a doctor in the UK at home or work, in person or by video. Having started out as nothing more than a vision, Zoomdoc is now confidently raising capital at a £10m valuation, having completed a £500k seed round that included Wimbledon Tennis Champion Andy Murray as one of the company’s investors.

Zoomdoc Founder, Kenny Livingstone, added: "I founded Zoomdoc with E-Man Venture Labs, and from an idea that didn’t exist, together, we conceived a business that went onto raise funding at a multi-million-pound valuation. Matt and Eugene have a model that delivers exceptional value at the beginning of a company’s life, and raising their own fund was an obvious next step. I am very excited to see what they build next and hope to be a future investor."

Zoomdoc Founder, Kenny Livingstone, added: "I founded Zoomdoc with E-Man Venture Labs, and from an idea that didn’t exist, together, we conceived a business that went onto raise funding at a multi-million-pound valuation. Matt and Eugene have a model that delivers exceptional value at the beginning of a company’s life, and raising their own fund was an obvious next step. I am very excited to see what they build next and hope to be a future investor."

Purpose before profits

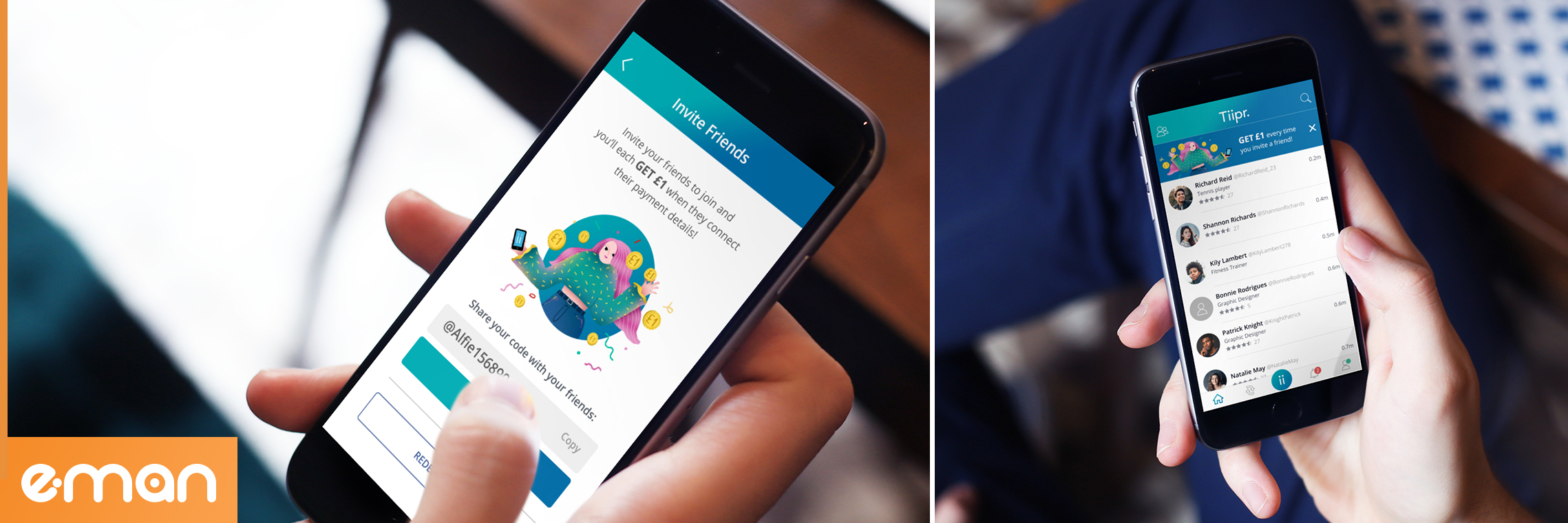

Hagger is keen to emphasise that E-Man Venture Labs will continue to favour projects which are socially beneficial: “Purpose before profits. We’re at a point, particularly in the UK, where we need to align with the objectives of this country. We have Tiipr, a location-based gratuity and smb payments platform, upon which you can discover anybody around you and in one tap, send them money.

So for example, with another of our alumni companies, Save the High Street, the alignment with Tiipr makes for a great collaboration. Tiipr is a payment and discovery solution for individuals, small businesses and traders, therefore it helps the local economy and small businesses to thrive, and that’s high up on our agenda.

We’ve been involved in Save The High Street for five years and remain the biggest shareholder outside of the founders, so we must continue to add value, give back to our alumni and connect the dots.”

Hagger adds: “It’s important to note that we come from very humble beginnings. We helped entrepreneurs to develop ideas when literally nobody else would. We’ve always had a real passion for entrepreneurs who wanted to change the world but didn’t know how to start and were actually being overlooked. We’ve filled gaps where the public sector may have been able to add greater value or institutions that were created to help entrepreneurs get going. We are keen to foster greater relationships with the government moving forward, and have great insights and intel to share.”

Hagger adds: “It’s important to note that we come from very humble beginnings. We helped entrepreneurs to develop ideas when literally nobody else would. We’ve always had a real passion for entrepreneurs who wanted to change the world but didn’t know how to start and were actually being overlooked. We’ve filled gaps where the public sector may have been able to add greater value or institutions that were created to help entrepreneurs get going. We are keen to foster greater relationships with the government moving forward, and have great insights and intel to share.”

Alex Schlagman, Founder and CEO of Save The Highstreet, endorses that approach: "E-Man is product development specialists and now, as they expand into venture studio model, I expect even greater results. When we partnered with E-Man we had nothing - no product, let alone product-market fit. The company partnered with us to take us to a place where we could become an independently funded company’

And Just Park founder Anthony Eskinazi reinforces the message. In 2016, unable to find anybody to help him get ParkatmyHouse.com to market, 13 years later, Just Park now employs 100 people and raised its last funding at a £40 million valuation. Eskinazi says: ‘We couldn't have asked for a more proactive and reliable service than what we got from E-Man.’

Paul Smith of E-Man alumni startup, Wise Amigo adds his testimony "Working with E-Man has enabled us to get a working MVP of WiseAmigo up and running to test and iterate. It gave us the tools to build for the next stage of development and we’re forever in their debt for taking a punt on us."

Creating start-ups within corporates

Another unique service which E-Man Venture Labs offers is the ability to generate internal start-ups for existing corporations. Hagger explains: “We can look at a company’s business and come up with ideas, where the distribution and customer base could benefit from something new. Companies acquire start-ups, simply because they want the talent that exists in those start-ups – and they also want to integrate start-ups’ products and services as new features, as well as acquiring customers, and to maintain or increase market caps.

“But why acquire a company when you can actually embark upon building a start-up as a separate entity? Until now, companies just haven’t had the necessary dynamic, fast-paced approach: that’s very hard when you’re a large corporation. So we come in and help to do that. Our model is very simple. We pitch established corporations an idea that will allow the company to invest and own the majority of the start up. E-Man retain a small percentage of the company, which can be acquired later once milestones are reached.”

Hagger cites how ‘Net Sorcerer’, the company’s desktop news alerts platform, provided enough innovation in 2004 to earn E-Man a government innovation award from Cambridge University Science Park and led to large companies such as Sky Sports using the idea as a means of breaking real-time news.

Ten ideas become three companies

E-Man Venture Labs will continue to pursue a policy which has always been central to E-Man since the company’s inception: to concentrate on three products per year, having drilled down from a potential pool of ten ideas. Currently, E-Man Venture Labs is developing Tiipr (described above) and Passport Power, an innovative travel-themed mobile game that follows on from the success of Augmented Reality (AR) treasure hunt Snatch in 2016. Passport Power provides real-world rewards and has the potential to operate as a travel industry disruptor. In addition, E-Man Ventures is preparing to enter the production of Infiltrate, a location-based AR mobile game which also provides real-world rewards and features genre-defining security-themed gameplay.

Hagger says: “To see the companies that E-Man participated in, from day one, and the impact they have had on London in terms of economic growth and job creation, is testimony to where we find ourselves, in having the backing of investors to source and finance the next crop of brilliant business founders via our company-creation process.”

Hagger says: “To see the companies that E-Man participated in, from day one, and the impact they have had on London in terms of economic growth and job creation, is testimony to where we find ourselves, in having the backing of investors to source and finance the next crop of brilliant business founders via our company-creation process.”

E-Man Venture Labs’ holding company is E-Man Asset Management Ltd and the latest crop of UK start-ups, owned by the organisation includes, ZoomDoc, Pocket High Street, Wise Amigo, Do I Date, Snatch, Tiipr and Passport Power.

2020 will see the launch of Construo and My Switch Pro.